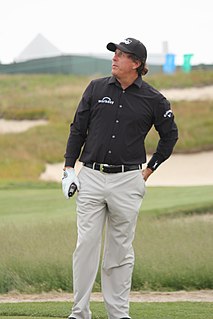

A Quote by Phil Mickelson

If you add up all the federal and you look at the disability and the unemployment and the Social Security and the state, my tax rate's 62, 63 percent. So I've got to make some decisions on what I'm going to do.

Related Quotes

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

The black unemployment rate has to be twice that of the white rate in the US. If the national unemployment rate were 6.8 percent, everyone would be freaking out. We ought to not take too much solace in the 6.8 percent, but ask ourselves what can we do to bring that down to white rates, which are below 4 percent now. Some of that has to do with education, but that's just part of the story. You find that those unemployment differentials persist across every education level. I think it means pushing back on discrimination and helping people who can't find work get into the job market.

Government is taking 40 percent of the GDP. And that's at the state, local and federal level. President Obama has taken government spending at the federal level from 20 percent to 25 percent. Look, at some point, you cease being a free economy, and you become a government economy. And we've got to stop that.

Obama wants to take the individual small business tax to 44 percent, and the corporate rate - he says - down to 28 percent or whatever. But that really damages the small businesses. And it doesn't make us competitive. You got to take them both down to 20, because state and local corporate taxes are 5 percent.

I forget what the relevant American rate is, but I can tell you that our goal is to have a combined federal-provincial corporate tax rate of no more than 25 percent. We're on target to do that by 2012. We will have significantly - by a significant margin the lowest corporate tax rates in the G-7, and that's our - our government's objective.

In Scandinavia probably the most worker-supportive part of the planet, they have the highest rate of chronic pain and worker-related disability. So any kind of pain and difficulty is so much unwelcome that if you say that you're in pain, we're going to even pay you full salary to quit work because you're burned out, inside that what you're going to create is gigantic amounts of chronic pain syndrome. Scandinavians spend 15 percent of their gross national product on disability. 50 percent of the public health nurses are on disability. And that's where we're headed in the U.S. too.

My financial adviser Ric Edelman...thinks the time to start educating people about money is when they are children. He's set up a retirement plan called the RIC-E-Trust that can provide retirement security. A $5,000 one-time tax-deferred investment at birth, with an average interest rate of ten percent compounded, means that a child would have $2.4 million when he or she is 65 years old. Who needs Social Security with that kind of nest egg?

I am 100 percent confident. This is a security review that was requested. It is being carried out. It will be resolved. But I have to add if there's going to be a security review about me, there's going to have to be security reviews about a lot of other people, including Republican office holders, because we've got this absurd situation of retroactive classifications.

I took office as president in January 2003, and in April 2003, I sent to Congress my first proposal for tax reform. Some parts were voted on, with respect to federal taxes, and then it came to a standstill. Why? Because each state is interested in its own tax reform, has its own tax policy, and each state has its federal deputies and senators.

Reform immigration to make it easy for individuals to come over here, be documented, pay taxes - immigration reform is needed to state that its about work, its not about welfare... Set up a grace period where they can get a work permit... social security card so that they can pay income tax, social security, Medicare.