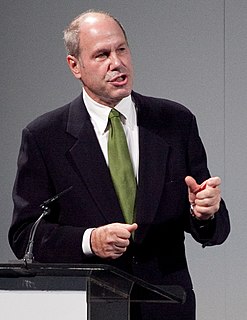

A Quote by Philip Arthur Fisher

The successful investor is usually an individual who is inherently interested in business problems.

Related Quotes

If the investor doesn't have enough time and skill to investigate individual stocks or enough money to diversify a portfolio, the right thing to do is to invest in exchange-traded funds that give you exposure to asset classes. It does make sense for the individual investor to think in terms of holding individual asset classes.

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

Ask yourself: Am I an investor, or am I a speculator? An investor is a person who owns business and holds it forever and enjoys the returns that U.S. businesses, and to some extent global businesses, have earned since the beginning of time. Speculation is betting on price. Speculation has no place in the portfolio or the kit of the typical investor.

we have complaints that institutional dominance of the stock market has put 'the small investor at a disadvantage because he can't compete with the trust companies' huge resources, etc. The facts are quite the opposite. It may be that the institutions are better equipped than the individual to speculate in the market.But I am convinced that an individual investor with sound principles, and soundly advised, can do distinctly better over the long pull than large institutions.

There are no bad business and investment opportunities, but there are bad entrepreneurs and investors. To be a successful business owner and investor, you have to be emotionally neutral to winning and losing. Winning and losing are just part of the game. The size of your success is measured by the strength of your desire, the size of your dream and how you handle disappointment along the way.

The individual investor should act consistently as an investor and not as a speculator. This means ... that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money's worth for his purchase.