A Quote by Philip Kotler

The key solution is to invest in innovation and entrepreneurship within the company. Reducing waste - although probably not eliminating it - and do so at all levels of government would probably generate the capital needed. Alas, that will probably not happen because it makes too much sense.

Related Quotes

I think markets are mechanisms that determine prices that are necessary for mass heterogenous populations, and markets do generate levels of technological innovation and productivity that is crucial. But when unregulated, they often generate levels of vast inequality and ugly isolation that makes it difficult for people to relate and connect with one another.

Intellectual-property rules are clearly necessary to spur innovation: if every invention could be stolen, or every new drug immediately copied, few people would invest in innovation. But too much protection can strangle competition and can limit what economists call 'incremental innovation' - innovations that build, in some way, on others.

I believe that most people would like to cooperate in reducing waste, but to encourage them, the national policy should be clear, well advertised, and consistent. Even within Greater London, there is a huge discrepancy between council policies. I believe a national waste management initiative should be designed and implemented by government.

We're just trying to end illegitimate government support for a single technology, which is un-American. We should be leading the world in the next generation of technological innovation. But we can't unleash private capital because of what the government is doing to stifle innovation and to choke competition.

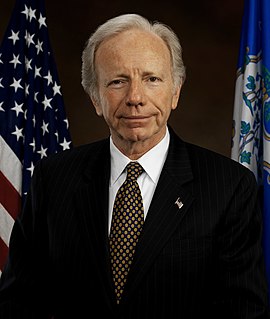

The solution is this: There will be a state of Palestine in all of the Occupied Territories of the West Bank and the Gaza Strip. The Green Line, the border that existed before 1967, will come into being again. Jerusalem will be the shared capital - East Jerusalem will be the capital of Palestine, West Jerusalem will be the capital of Israel. All settlements must be evacuated. The security must be arranged for both people, and there must be a moral solution and a practical solution.

The government also has to get the public rules right. That means putting a price on carbon, so the cleaner forms of energy become more competitive. As soon as that happens, a tidal wave of new capital, innovation and entrepreneurship will flood into the clean energy space - creating new jobs and opportunities for Americans of all walks of life. We did that for the internet, with public investments in the basic system through the Pentagon, followed by rules that encouraged innovation and competition. And that is why the internet took off in the United States first.

Obviously, consideration of costs is key, including opportunity costs. Of course capital isn't free. It's easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital. They say that if you're generating a 100% return on capital, then you shouldn't invest in something that generates an 80% return on capital. It's crazy.