A Quote by Philip Russell

His victims were for the most part financial institutions who exact their revenge in courtrooms.

Quote Topics

Related Quotes

Financial institutions are not being bailed out as a favor to them or their stockholders. In fact, stockholders have come out worse off after some bailouts. The real point is to avoid a major contraction of credit that could cause major downturns in output and employment, ruining millions of people, far beyond the financial institutions involved. If it was just a question of the financial institutions themselves, they could be left to sink or swim. But it is not.

FinCEN directs financial institutions to file suspicious activity reports (SARs) to inform law enforcement of certain types of cyber-enabled crime. As the agency charged with protecting the United States from financial crime, FinCEN's guidance does not deem financial institutions who process such transactions to be involved in a criminal activity.

By any measure, CapitalSource outperformed both our direct competitors and the financial services industry in general, particularly in the context of the near collapse of the financial services industry where 19 of the 20 largest financial institutions in the country either failed or were bailed out by the government.

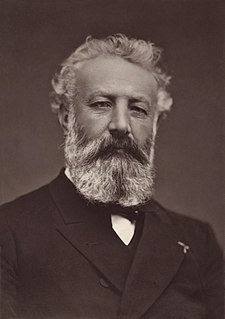

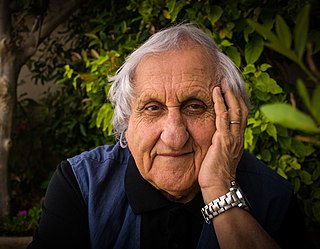

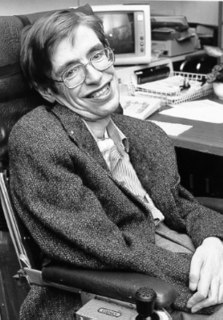

As the worldly philosophers of the past affirmed, the goal of economics is to improve the way society functions. In The New Financial Order, Robert Shiller joins this proud tradition by directing his brilliant economic skills toward the creation of financial institutions designed to reduce the risks an unknown future visits on most members of our society and others. Shiller's imaginative and compelling analysis will appeal to all readers who share his passion for initiating not only a richer, but a better, century.