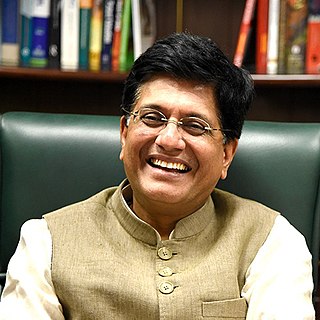

A Quote by Piyush Goyal

More taxes mean more money to spend for public welfare.

Quote Topics

Related Quotes

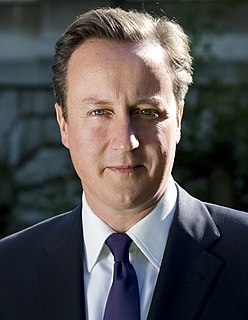

I came into politics partly because I want to be able to reduce taxes so that individuals have more of their money to spend, so that businesses have more of their money to create jobs, but I believe that lower taxes are sustainable when you get the public finances in order, so I will only make promises I can keep on taxation.

Lower taxes will stimulate your own personal economy by leaving more money in your pocket to do what you want - invest, save, spend, buy a bigger house, a nicer car, and give to charity. And lower taxes also lead to more money for the government to use on those things they've promised you. It's a win-win for everyone.

To lay taxes to provide for the general welfare of the United States, that is to say, 'to lay taxes for the purpose of providing for the general welfare.' For the laying of taxes is the power, and the general welfare the purpose for which the power is to be exercised. They are not to lay taxes ad libitum for any purpose they please; but only to pay the debts or provide for the welfare of the Union.

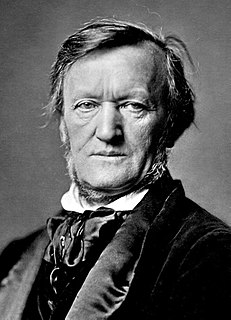

Whether government finances its added spending by increasing taxes, by borrowing, or by inflating the currency, the added spending will be offset by reduced private spending. Furthermore, private spending is generally more efficient than the government spending that would replace it because people act more carefully when they spend their own money than when they spend other people's money.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

The history of the welfare state is the history of public enterprise pushing out private organization. The impact was largely unintentional, but natural and inevitable. Higher taxes left individuals with less money to give; government's assumption of responsibility for providing welfare shriveled the perceived duty of individuals to respond to their neighbors' needs; and the availability of public programs gave recipients an alternative to private assistance, one which did not challenge recipients to reform their destructive behavior.

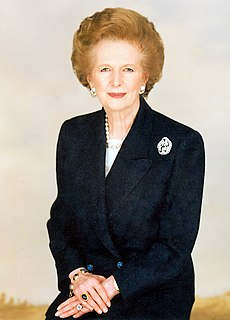

Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more. It is no good thinking that someone else will pay - that 'someone else' is you. There is no such thing as public money; there is only taxpayers' money.

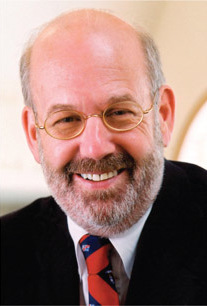

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.