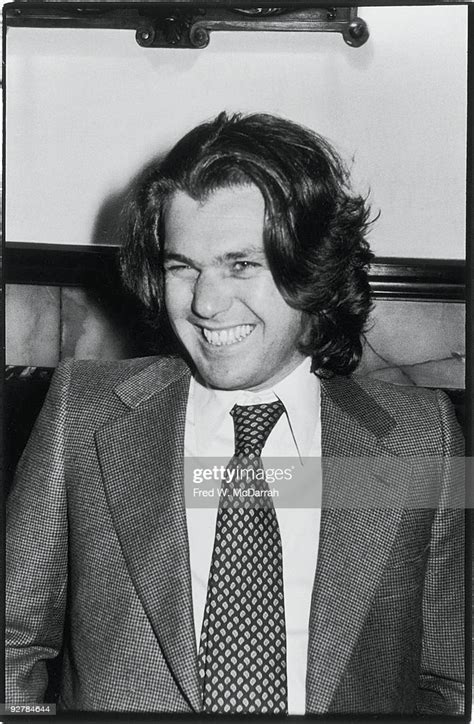

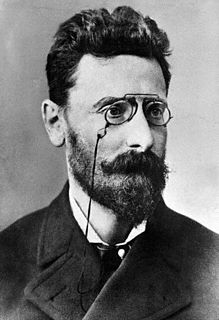

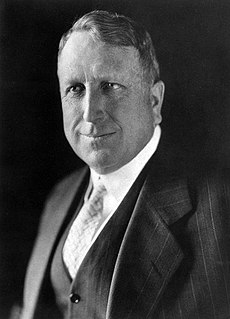

A Quote by Porter Stansberry

Currency regimes in the past were always destroyed by volatility. So sooner or later, people desire a currency that is stable.

Quote Topics

Related Quotes

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

The regulator banned cryptocurrency... then there was an order from the Supreme Court. So, in the absence of any strong law, it was very important for us to come out with a comprehensive law-one for the private digital currency and second for the government for its digital form of currency, or the virtual currency.

What there is no dispute about is whether or not China is a currency manipulator. They are a currency manipulator. They actively intervene every single day to keep the value of their currency less than it would be against the dollar than if it floated freely. We think. Even China barely disputes that.

It is very difficult to enter a single currency zone having fairly weak economic parameters and maintain a favourable state of the economy, not to mention positive growth rates. We have witnessed it not only in Europe, but for example in Argentina (nearly 10 years ago or more), when they tied the national currency to the dollar and later they did not know what to do about it.