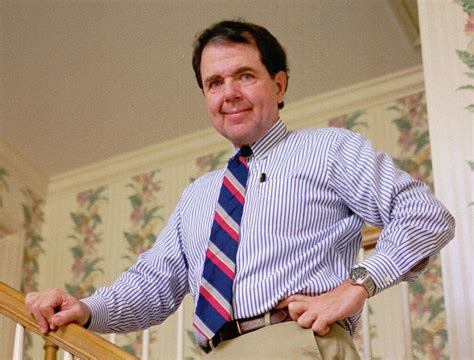

A Quote by Porter Stansberry

You can survive your income falling if it's not dramatic. Your income can decrease for a long time before you start living beyond your means.

Related Quotes

What starting your company means: you will lose your stable income, your right to apply for a leave of absence, and your right to get a bonus. However, it also means your income will no longer be limited, you will use your time more effectively, and you will no longer need to beg for favours from people anymore.

Your income is a direct reward for the quality and quantity of the services you render to your world. Whatever field you are in, if you want to double your income, you simply have to double the quality and quantity of what you do for that income. Or you have to change activities and occupations so that what you are doing is worth twice as much.

Remember life insurance is intended as income replacement to help dependents and or/spouse pay for things that your income would have covered. When you get to the point that you're dependents (Your kids mostly) aren't dependent on your income, you could reduce the amount of life insurance you are carrying.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

If you're a full-time manager of your own property - and full-time, according to Congress, is 15 hours a week - you can take unlimited depreciation and use it to offset your income from other areas and pay little in tax. One of the biggest real estate tax lawyers in New York said to me, if you're a major real estate family and you're paying income taxes, you should sue your tax lawyer for malpractice.