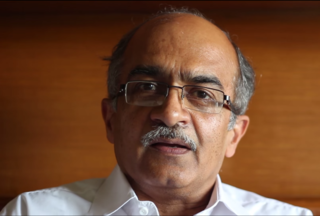

A Quote by Pratik Gandhi

To be honest, I've never invested in the stock market. My grandmother used to warn us against the stock exchange. My grandfather had lost a lot money in the share market. We are a working class family.

Related Quotes

And at a relatively early age, ten or so, I invested my first share of stock. And I used to follow, look at companies and so forth. But throughout the whole period, and indeed right through my college years, while I was involved in the stock market, always interested in finance, I never thought of it as a full-time job.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

One of the ironies of the stock market is the emphasis on activity. Brokers, using terms such as 'marketability' and 'liquidity,' sing the praises of companies with high share turnover... but investors should understand that what is good for the croupier is not good for the customer. A hyperactive stock market is the pick pocket of enterprise.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

It is argued by our GDP obsessed policy planners that eventually the money being made by the stock market operators or the IT industry would trickle down to the poor farmers in terms of ancillary jobs that would be created. But the fact is, that this has not happened, despite the boom in the stock market and the IT industry.