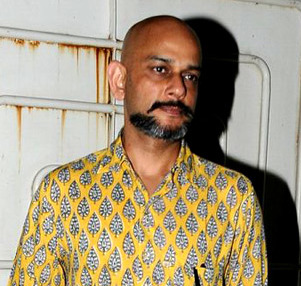

A Quote by Pratik Gandhi

In 1992, I was in school. I did hear about Harshad Mehta and one of my cousins lost some money in the stock market, but I knew little about it.

Related Quotes

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you'll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there's a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

No matter how you feel about your extended family or family gatherings you will be attending. This is because now the ultimate reason for attending family gatherings is for your children to have the time of their lives with their cousins. Little kids love their cousins. I’m not being cute or exaggerating here. Cousins are like celebrities for little kids. If little kids had a People magazine, cousins would be on the cover. Cousins are the barometers of how fun a family get-together will be. “Are the cousins going to be there? Fun!

I knew a guy who had $5 million and owned his house free and clear. But he wanted to make a bit more money to support his spending, so at the peak of the internet bubble he was selling puts on internet stocks. He lost all of his money and his house and now works in a restaurant. It's not a smart thing for the country to legalize gambling [in the stock market] and make it very accessible.