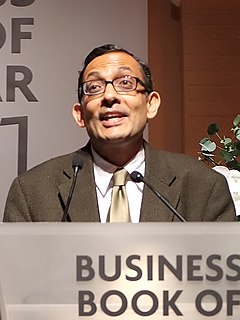

A Quote by Raghuram Rajan

Everyone may have some advise for the RBI. Some may advise, 'Cut your lending rates and raise the deposit rate.' How will a bank function? We take a medium term view. The bank has an 80-year-old history. I don't want to destroy it for a few decisions.

Related Quotes

The lesson for Asia is; if you have a central bank, have a floating exchange rate; if you want to have a fixed exchange rate, abolish your central bank and adopt a currency board instead. Either extreme; a fixed exchange rate through a currency board, but no central bank, or a central bank plus truly floating exchange rates; either of those is a tenable arrangement. But a pegged exchange rate with a central bank is a recipe for trouble.

I want to work in a bank, definitely. Hopefully, my acting career will go well. But if it doesn't, I go to a bank. If it does, then even at the age of 40, I will still go to a bank, but I have to work in a bank, because I'm really fond of taxation and accounts and investments and all of that. So I will do it. At some point, I will, yes.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

The Koreans that make their money in our community: If we have a Black bank, you'll find they don't deposit anything of what they take from us into a Black bank that would serve our community. They set up a bank in their own community. The Honorable Elijah Muhammad, my Teacher, called people like this "Bloodsuckers of the poor." All they want is to make a dollar, and run.

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

The federal [bank deposit] insurance scheme has worked up to now simply and solely because there have been very few bank failures. The next time we have a pestilence of them it will come to grief quickly enough, and if the good banks escape ruin with the bad ones it will be only because the taxpayer foots the bill.