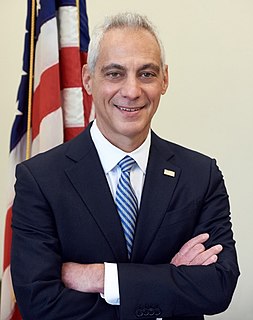

A Quote by Rahm Emanuel

There was no blueprint or how-to manual for fixing a global financial meltdown, an auto crisis, two wars and a great recession, all at the same time.

Related Quotes

The financial crisis and the Great Recession demonstrated, in a dramatic and unmistakable manner, how extraordinarily vulnerable are the large share of American families with very few assets to fall back on. We have come far from the worst moments of the crisis, and the economy continues to improve.

Detroit's financial challenges - the decline of the American auto industry, the impact of the global economic recession, declining population, and an erosion of the municipal tax base - are key to understanding what led this great city to an inability to provide basic city services or to carry out the normal functions of a municipality.

China's accumulation of reserves is a result of the IMF's mismanagement of the Asian financial crisis a decade or so ago. If countries know they can't rely on the IMF to help them, their best defense is their own reserve cushion. In a time of spreading global recession, too much emphasis on savings in surplus countries like China can impede prospects for global growth.

Beside the two wars he inherited in Iraq and Afghanistan, and promised to end, a financial crisis at home had pushed the United States to the brink of another Great Depression. When we spoke with the new president in March of 2009, the economy was losing 800,000 jobs a month, the government was throwing hundreds of billions of dollars at failing banks, and the auto industry was on the verge of collapse. Politically pummeled from all sides, Obama did his best to keep a sense of humor.

The global financial crisis is a great opportunity to showcase and propagate both causal and moral institutional analysis. The crisis shows major flaws in the way the US financial system is regulated and, more importantly, in our political system, which is essentially a bazaar of legalized bribery where financial institutions can buy themselves the governmental regulations they want, along with the regulators who routinely receive lucrative jobs in the industry whose oversight had formerly been their responsibility, the so-called revolving-door practice.