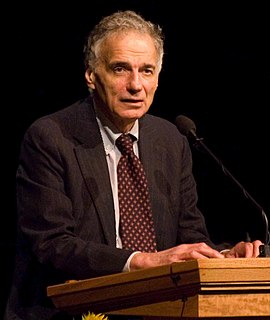

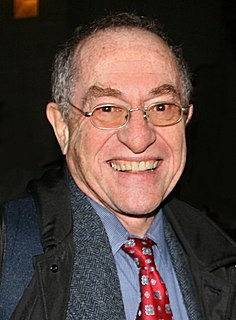

A Quote by Ralph Nader

In the meantime the big corporations are fleeing America for tax havens and places like Ireland, Luxembourg and the Grand Cayman Islands; the rich are finding more tax loopholes to expect; so when are the people going to basically roll up their sleeves and say, we've had enough, we're going to recapture Congress.

Related Quotes

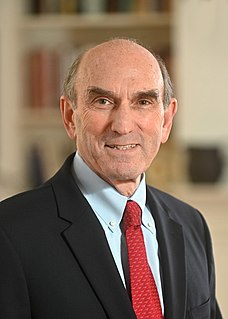

In 1990, about 1 percent of American corporate profits were taken in tax havens like the Cayman Islands. By 2002, it was up to 17 percent, and it'll be up to 20-25 percent very quickly. It's a major problem. Fundamentally, we have a tax system designed for a national, industrial, wage economy, which is what we had in the early 1900s. We now live in a global, asset-based, services world. And we need to have a tax system that follows the economic order or it's going to interfere with economic growth, it's going to reduce people's incomes, and it's going to damage the US.

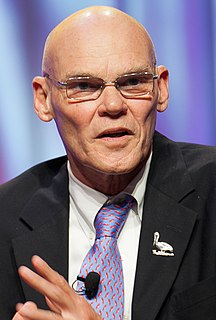

Now all of the ideas that I'm talking about, they are not radical ideas. Making public colleges and universities tuition free, that exists in countries all over the world, used to exist in the United States. Rebuilding our crumbling infrastructure, and creating 13 million jobs by doing away with tax loopholes that large corporations now enjoy by putting their money into the Cayman Islands and other tax havens. That is not a radical idea.

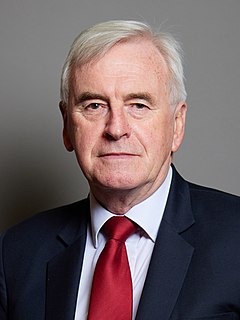

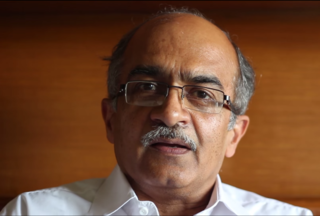

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

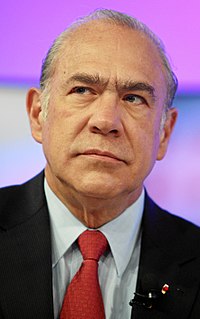

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

Much of the blame for the situation lies with the states themselves. They haven't been able to pass decent laws. For decades, tax authorities have been taking aim at the phenomenon of tax havens, and the most aggravating thing is that they aren't just in Bermuda or on the Cayman Islands, but right outside our front door.

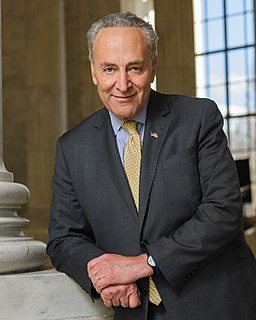

When I talked about Boeing and I talked about General Electric, what I was referring to is an outrage... Right now you have a loophole such that these guys are putting their profits, multi-billion dollar profitable corporations putting billions of dollars into the Cayman Islands, Bermuda, and other tax havens.

If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool.

I hope people understand that when you tax corporations that the concrete and the steel and the plastic don't pay. People pay. And so when you tax corporations, either the employees are going to pay or the shareholders are going to pay or the customers are going to pay. And so corporations are people.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.