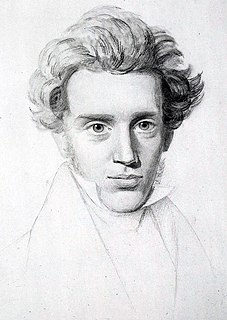

A Quote by Ralph Waldo Emerson

What a benefit would the American government, not yet relieved of its extreme need, render to itself, and to every city, village and hamlet in the States, if it would tax whiskey and rum almost to the point of prohibition! Was it Bonaparte who said that he found vices very good patriots? "He got five millions from the love of brandy, and he should be glad to know which of the virtues would pay him as much." Tobacco and opium have broad backs, and will cheerfully carry the load of armies, if you choose to make them pay high for such joy as they give and such harm as they do.

Quote Topics

Almost

American

American Government

Armies

Backs

Benefit

Bonaparte

Brandy

Broad

Carry

Choose

City

Every

Extreme

Five

Found

Give

Glad

Good

Got

Government

Hamlet

Harm

High

Him

Itself

Joy

Know

Load

Love

Make

Millions

Much

Need

Opium

Patriots

Pay

Point

Prohibition

Relieved

Render

Rum

Said

Should

States

Tax

Them

Tobacco

Very

Very Good

Vices

Village

Virtues

Which

Whiskey

Will

Would

You Choose

Related Quotes

We should balance the budget. If government programs are important enough, we need to pay for them with taxes or make cuts in lesser programs. We've lost that discipline entirely. It seems prudent to avoid the possibility that the people who own our debt will start to worry the U.S. won't pay. That would raise how much it would cost the U.S. to borrow, which in a national emergency, like a war or pandemic, could be critical.

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

The influence of (the national parks) is far beyond what is usually esteemed or usually considered. It has a relation to efficiency -- the working efficiency of the people, to their health, and particularly to their patriotism -- which would make the parks worth while, if there were not a cent of revenue in it, and if every visitor to the parks meant that the Government would have to pay a tax of $1 simply to get him there.

Thomas Jefferson despised newspapers, with considerable justification. They printed libels and slanders about him that persist to the present day. Yet he famously said that if he had to choose between government without newspapers and newspapers without government, he would cheerfully choose to live in a land with newspapers (even not very good ones) and no government.

I want you to say dreadfully mad, funny things and make up songs and be--' The Will I fell in love with, she almost said. "And be Will," she finished instead. "Or I shall hit you with my umbrella." *** "You would make a very ugly woman." "I would not. I would be stunning." Tessa laughed. “There,” she said. “There is Will. Isn’t that better? Don’t you think so?” “I don’t know,” Will said, eyeing her. “I’m afraid to answer that. I’ve heard that when I speak, it makes American women wish to strike me with umbrellas.

Alcoholism, the opium habit and tobaccoism are a trio of poison habits which have been weighty handicaps to human progress during the last three centuries. In the United States, the subtle spell of opium has been broken by restrictive legislation; the grip of the rum demon has been loosened by the Prohibition Amendment to the Constitution, but the tobacco habit still maintains its strangle-hold and more than one hundred million victims of tobaccoism daily burn incense to the smoke god.

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

This was years ago, I think during the early [Ronald] Reagan years. I came up with a plan that everybody just pay $8.95 in taxes. Cheating would be allowed. But the incentive to cheat wouldn't be nearly as great if you only had to pay the $8.95. There were a few people who would have to pay hundreds of millions of dollars under this plan. I think it was Mark Goodson and Bill Todman, the guys who do the quiz shows. But almost everybody else would be off really cheap.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.