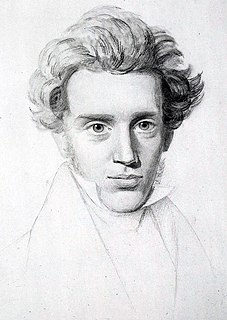

A Quote by Ralph Waldo Emerson

Related Quotes

The tax upon land values is the most just and equal of all taxes. It falls only upon those who receive from society a peculiar and valuable benefit, and upon them in proportion to the benefit they receive.It is the taking by the community for the use of the community of that value which is the creation of the community. It is the application of the common property to common uses. When all rent is taken by taxation for the needs of the community, then will the equality ordained by nature be attained.

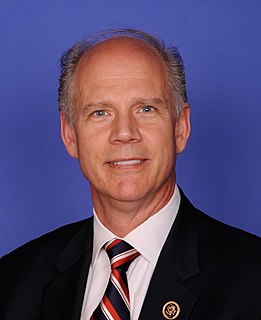

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.

Trump himself stands to benefit dramatically from the tax cuts. One of the things they're cutting is the alternative minimum tax. Last time we have tax returns for him was in 2005, where he paid about $31 million because of the alternative minimum tax. He won't have to pay that, if this tax bill goes through. So, not only is he reordering our constitutional democracy, he is personally enriching himself - which is not new, because, of course, he's done it ever since he swore an oath to become president of the United States.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.