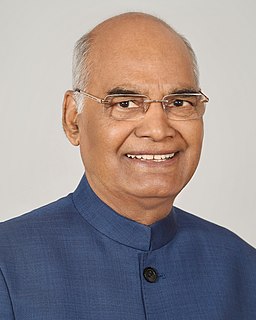

A Quote by Ram Nath Kovind

As a result of the policies of my government, black money in real estate sector has declined substantially, the prices of houses have come down and the dream of a normal middle class family for possessing their own house is being realised.

Related Quotes

The government decides to try to increase the middle class by subsidizing things that middle class people have: If middle-class people go to college and own homes, then surely if more people go to college and own homes, we’ll have more middle-class people. But homeownership and college aren’t causes of middle-class status, they’re markers for possessing the kinds of traits — self-discipline, the ability to defer gratification, etc. — that let you enter, and stay, in the middle class. Subsidizing the markers doesn’t produce the traits; if anything, it undermines them.

The Black public sector middle class teachers, policeman, firemen, and post office workers, those jobs have been on the decline but there hasn't been a corresponding increase in the private sector. What is especially painful is government policy bailed out the banks without making them make reinvestments for rebuilding. The result is 53-million Americans are food insecure, 50-million Americans are in poverty, 44 million are on food stamps, 26 million are looking for a job.

I would buy a house, and try to buy a house every month. I didn't have education or information about real estate at the time. I learned after I bought a few houses, and then I kind of fell in love with the rehabbing of the houses and fixing them up and just the whole process and turned it into a business.

Today the strategies of many companies in the real estate industry are premised on low interest rates, an assumption that has resulted in the rapid expansion of the real estate securitization business. This trend could be regarded as a risk factor, as it exposes the real estate sector to at least three potential problems: first, interest rate hikes; second, revisions to securitization business accounting standards; and third, overheating in the real estate market.

Kids who are middle class, socioeconomically, are surrounded by mentors. They have coaches, teachers, they have family friends, their parents have friends. They might have opportunities, they might have jobs that allow them to experience things that kids in poverty often don't have. Sometimes they come from dysfunctional families. And when you come from a family where money's a real challenge, then it might not be a priority to get you into a summer internship.

For many people, the mortgages they took out before 2008 are so high that they would be better off walking away from their houses. That is called "jingle mail," returning the keys to the bank and saying, "You can have the house. I can buy the house next door that's just like this for 20% less, so I'm going to save money and switch." That's what someone like Donald Trump or a real estate investor would do. But the banks are trying to convince the mortgage debtors, the homeowners, not to act in their own self-interest.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

We [the Republicans] help the middle class when we unburden them from the very policies that Hillary Clinton would double down on. She champions Big Government, which we know enables crony capitalism and exacerbates inequality. If you are wealthy, powerful and well-connected, you can handle Big Government.