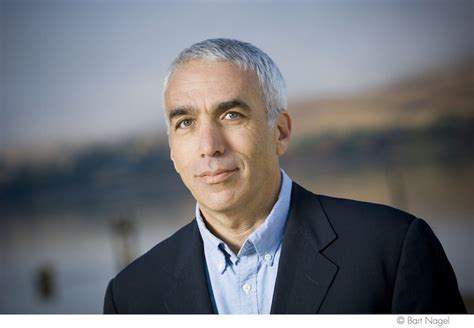

A Quote by Randy Neugebauer

The thing about markets, and I think the thing people don't understand about that, is markets are not kind, but they're very efficient. So when the marketplace determines an inefficiency in the system, it corrects that, and a market system that's left alone will reward good behavior and punish bad behavior.

Related Quotes

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behavior of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace.

Once and for all, people must understand that addiction is a disease. It’s critical if we’re going to effectively prevent and treat addiction. Accepting that addiction is an illness will transform our approach to public policy, research, insurance, and criminality; it will change how we feel about addicts, and how they feel about themselves. There’s another essential reason why we must understand that addiction is an illness and not just bad behavior: We punish bad behavior. We treat illness.

The main purpose of advertising is to undermine markets. If you go to graduate school and you take a course in economics, you learn that markets are systems in which informed consumers make rational choices. That's what's so wonderful about it. But that's the last thing that the state corporate system wants. It is spending huge sums to prevent that.

I mean the whole economy just comes to a grinding halt. Competence in markets and in institutions, it's a lot like oxygen. When you have it, you don't even think about it. Indispensable. You can go years without thinking about it. When it's gone for five minutes, it's the only thing you think about. And the oxygen has been sucked out of the credit markets.

To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices.