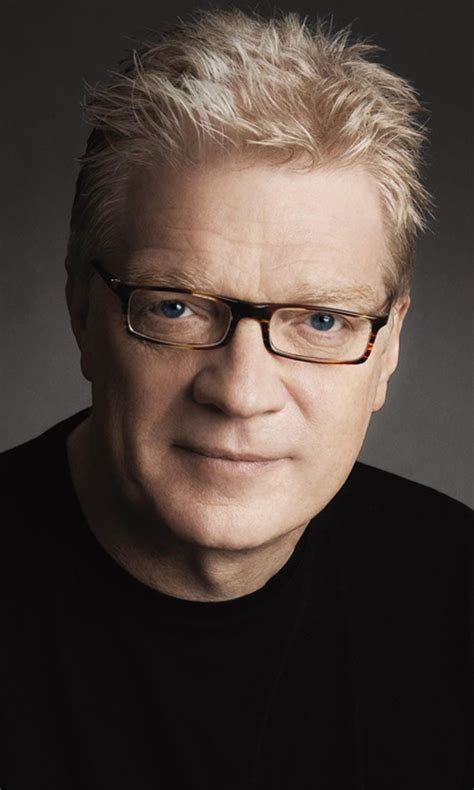

A Quote by Randy Pausch

There are more ways than one to measure profits and losses.

Related Quotes

In many ways, large profits are even more insidious than large losses in terms of emotional destabilization. I think it's important not to be emotionally attached to large profits. I've certainly made some of my worst trades after long periods of winning. When you're on a big winning streak, there's a temptation to think that you're doing something special, which will allow you to continue to propel yourself upward. You start to think that you can afford to make shoddy decisions. You can imagine what happens next. As a general rule, losses make you strong and profits make you weak.

In a crisis, stocks of financial companies are great investments, because the tide is bound to turn. Massive losses on bad loans and soured investments are irrelevant to value; improving trends and future prospects are what matter, regardless of whether profits will have to be used to cover loan losses and equity shortfalls for years to come.

Even with a margin of safety in the investor's favor, an individual security may work out badly. For the margin guarantees only that he has a better chance for profit than for loss - not that loss is impossible. But as the number of such commitments is increased the more certain does it become that the aggregate of the profits will exceed the aggregate of the losses.