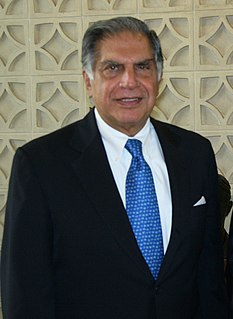

A Quote by Ratan Tata

IT and the entire communications business clearly have the greatest potential for growth. But if you're talking about sheer size, the steel and auto industries will remain at the top.

Related Quotes

I've been told that certain species of fish will grow according to the size of their environment. Put them in a tiny aquarium, and they remain small even at adulthood. Release them into a huge natural body of water, and they grow into their intended size. People are similar. If they live in a harsh and limiting environment, they stay small. But put them someplace that encourages growth, and they will expand to reach their potential.

Growth is the mantra of our society because the economy can't remain healthy without growth.Impregnable monopolies aside (and these are few), profits are both the hallmark of capitalism and its Achilles heel, for no business can permanently maintain its prices much above its costs. There is only one way in which profits can be perpetuated; a business-or an entire economy-must grow.

I think the Tata Group's greatest contribution to the growth of the Indian economy and Indian industry probably happened in the pre-independence era. The Group's investments in industries such as steel, textiles, power and hotels were certainly driven by an entrepreneurial spirit, but they were driven even more, I think, by a desire to make India self-sufficient and independent of its colonial masters then.

As a small business or startup, one of the factors you should always consider when looking at a potential partnership is the incremental potential reach. Note that wider reach doesn't always mean a better partnership opportunity. Instead of sheer scale, take a look at which communities your potential partner can open up for you.

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.