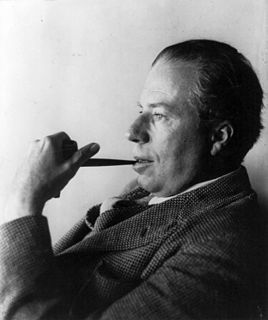

A Quote by Ravi Zacharias

An expenditure of words without income of ideas will lead to intellectual bankruptcy.

Quote Topics

Related Quotes

I guess you will have to go to jail. If that is the result of not understanding the Income Tax Law, I will meet you there. We shall have a merry, merry time, for all our friends will be there. It will be an intellectual center, for no one understands the Income Tax Law except persons who have not sufficient intelligence to understand the questions that arise under it.

I do not believe one can settle how much we ought to give. I am afraid the only safe rule is to give more than we can spare. In other words, if our expenditure on comforts, luxuries, amusements, etc, is up to the standard common among those with the same income as our own, we are probably giving away too little. If our charities do not at all pinch or hamper us, I should say they are too small. There ought to be things we should like to do and cannot do because our charitable expenditure excludes them.

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

Owners of capital will stimulate working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks which will have to be nationalized and State will have to take the road which will eventually lead to communism.

It is of the greatest consequence that the debt should, with the consent of the creditors, be remoulded into such a shape as will bring the expenditure of the nation to a level with its income. Till this shall be accomplished, the finances of the United States will never wear a proper countenance. Arrears of interest, continually accruing, will be as continual a monument, either of inability, or of ill faith and will not cease to have an evil influence on public credit.

Mathematicians may flatter themselves that they possess new ideas which mere human language is as yet unable to express. Let them make the effort to express these ideas in appropriate words without the aid of symbols, and if they succeed they will not only lay us laymen under a lasting obligation, but, we venture to say, they will find themselves very much enlightened during the process, and will even be doubtful whether the ideas as expressed in symbols had ever quite found their way out of the equations into their minds.

We teach children to save their money. As an attempt to counteract thoughtless and selfish expenditure, that has value. But it is not positive; it does not lead the child into the safe and useful avenues of self-expression or self-expenditure. To teach a child to invest and use is better than to teach him to save.