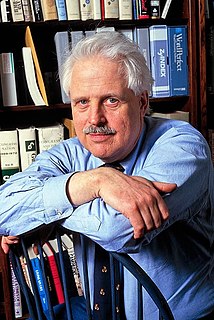

A Quote by Reince Priebus

Most Americans agree that federal money, their tax money shouldn't be used to help pay for abortions.

Related Quotes

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

What the Trump tax plan is a plan to give tiny little tax cuts to most Americans, raise taxes on perhaps one in five families and shower benefits on people who earn millions of dollars a year. And this fits with a fundamental principle the Republicans have been pursuing for a long time. The rich aren't investing and creating jobs, because they don't have nearly enough money, and so we need to get them money. And the way the Republicans want to get it to them is tax cuts first, and then to take away help for children, the disabled, the elderly and the poor.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.

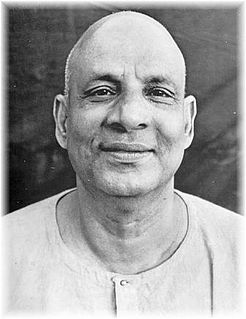

Money can help you to get medicines but not health. Money can help you to get soft pillows, but not sound sleep. Money can help you to get material comforts, but not eternal bliss. Money can help you to get ornaments, but not beauty. Money will help you to get an electric earphone, but not natural hearing. Attain the supreme wealth, wisdom; you will have everything.

We believe the Senate language provides for federal subsidies for abortions. Plus theres a language in there where you have to pay one dollar per month, every enrollee, to pay for a fund for reproductive rights which include abortion. And thats totally against federal law. So we are saying take that out.

We believe the Senate language provides for federal subsidies for abortions. Plus there's a language in there where you have to pay one dollar per month, every enrollee, to pay for a fund for reproductive rights which include abortion. And that's totally against federal law. So we are saying take that out.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.

I'm a big believer in getting money from where the money is, and the money is in Washington. I learned from running the Olympics that you can get money there to help build economic opportunities. We actually got over $410 million from the federal government; that is a huge increase over anything ever done before. We did that by going after every agency of government. That kind of creativity I want to bring to everything we do (in Massachusetts).