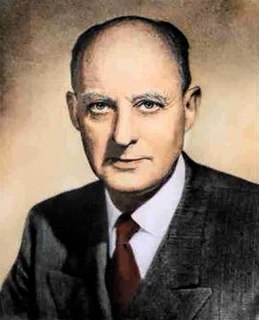

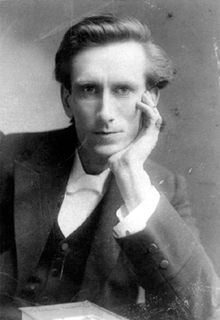

A Quote by Reinhold Niebuhr

The idea that the profits of capital are really the rewards of a just society for the foresight and thrift of those who sacrificed the immediate pleasures of spending in order that society might have productive capital, had a certain validity in the early days of capitalism, when productive enterprise was frequently initiated through capital saved out of modest incomes.

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

The brilliant creative core of capitalism ... is the story the entrepreneurs and capital investors tell themselves about the future. How they intend to alter it, what they expect to gain in return, where they will raise the capital to accomplish their vision. Many of their stories turn out to be flawed or mistaken, of course, but the capacity to envision a set of future events and then act to fulfill them is a central source of capitalism's strength and its dominance of society.

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.

Those subject to capital punishment are real human beings, with their own backgrounds and narratives. By contrast, those whose lives are or might be saved by virtue of capital punishment are mere 'statistical people.' They are both nameless and faceless, and their deaths are far less likely to be considered in moral deliberations.

I don't want to overvalue Donald Trump as some historical rupture, and to admit that I do think Trump is an indication of a fairly profound change. But the change started a while ago, and it has taken a while to appear. Global capital, particularly western capital, has been in decline since the late 60s and early 70s. The softness appeared in the 60s, the profit rate fell off the table in 1972 - 73, and there have been very uneven recoveries. This has been an ongoing weakening of the productive economy of accumulation at a global scale, of capital's capacity to expand.

It's a tract against capital punishment in the genre of Swift's Modest Proposal. I was simply following a formula to its logical conclusion. Some people appear to have understood it. The publication of Naked Lunch in England practically coincided with their abolition of capital punishment. The book obviously had a certain effect.