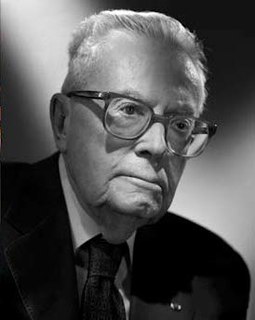

A Quote by Richard Arnold Epstein

Reflecting an amalgam of economics, monetary, and psychological factors, the stock market represents possibly the most subtly intricate game invented by man.

Related Quotes

Treatment of the apparently whimsical fluctuations of the stock quotations as truly non stationary processes requires a model of such complexity that its practical value is likely to be limited. An additional complication, not encompassed by most stock market models, arises from the manifestation of the market as a nonzero sum game.

It takes a man a long time to learn all the lessons of all of his mistakes. They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. It took me longer to get that general principle fixed firmly in my mind than it did most of the more technical phases of the game of stock speculation.

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.

The correct attitude of the security analyst toward the stock market might well be that of a man toward his wife. He shouldn't pay too much attention to what the lady says, but he can't afford to ignore it entirely. That is pretty much the position that most of us find ourselves vis-à-vis the stock market.

We invented marriage. Couples invented marriage. We also invented divorce,mind you. And we invented infidelity,too, as well as romantic misery. In fact we invented the whole sloppy mess of love and intimacy and aversion and euphoria and failure. But most importantly of all, most subversively of all, most stubbornly of all, we invented privacy.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.