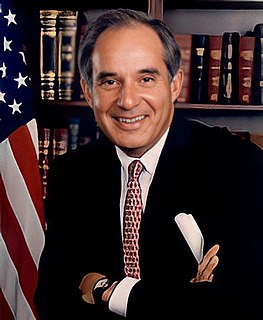

A Quote by Richard Burr

Repeal of the individual AMT has been a fundamental element of Republican tax reform campaign promises for years.

Quote Topics

Related Quotes

I may sound naive, since everyone's decided the next two years are going to be all about 2016, but I look at what's happened over the years when there's been divided government. That's when we've done tax reform, that's when we've done entitlement reform - to move this economy forward on these big issues.

Candidates run for election on campaign promises, but once they're elected they renege on those promises, which happened with President [Barack] Obama on Guantánamo, the surveillance programs and investigating the crimes of the Bush administration. These were very serious campaign promises that were not fulfilled.

Donald Trump had probably the biggest mandate to do things of any recent president because of the specifics of his agenda and his campaign. So many times a day he announced what he was gonna do. So he was elected, he won; therefore, he's got a mandate. And his party is not assisting and not helping, and they're even violating promises they made for seven years on the repeal and replace Obamacare.

I think, again, the overall intellectual structure of the speech is very much consistent with what Donald Trump has been saying on the campaign trail. He's against free trade. He's against immigration. But he has been in favor of tax reform, and he has been afraid of - in favor of developing American energy sources like through fracking or hydraulic fracturing.

A good place to start a more civil dialog would be for my Republican colleagues in the House to change the name of the bill they have introduced to repeal health care reform. The bill, titled the "Repeal the Job Killing Health Care Law Act," was set to come up for a vote this week, but in the wake of Gabby's shooting, it has been postponed at least until next week. Don't get me wrong - I'm not suggesting that the name of that one piece of legislation somehow led to the horror of this weekend - but is it really necessary to put the word "killing" in the title of a major piece of legislation?