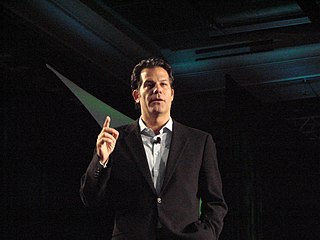

A Quote by Richard Florida

We need to remake and reinvent our housing system so that it supports the flexibility and mobility of our economic system broadly. Home-ownership is rewarded by the federal tax code, which made great sense when that piece of the American Dream, and all the consumption that came with it, was essential to rebuilding the economy. These days, however, it feels like a huge penalty to people who want to travel light within the new mobile economy without a mortgage to hold them back.

Quote Topics

American

American Dream

Back

Came

Code

Consumption

Days

Dream

Economic

Economic System

Economy

Essential

Federal

Feels

Flexibility

Great

Hold

Home

Housing

However

Huge

Light

Light Within

Like

Made

Mobile

Mobility

Mortgage

Need

New

Our

Ownership

Penalty

People

Piece

Rebuilding

Reinvent

Remake

Rewarded

Sense

Supports

System

Tax

Them

These Days

Travel

Travel Light

Want

Want To Travel

Which

Within

Without

Related Quotes

Housing has always been a key to Great Resets. During the Great Depression and New Deal, the federal government created a new system of housing finance to usher in the era of suburbanization. We need an even more radical shift in housing today. Housing has consumed too much of our economic resources and distorted the economy. It has trapped people who are underwater on their mortgages or can't sell their homes. And in doing so has left the labor market unable to flexibly adjust to new economic realities.

It's time to admit that public education operates like a planned economy, a bureaucratic system in which everybody's role is spelled out in advance and there are few incentives for innovation and productivity. It's no surprise that our school system doesn't improve: It more resembles the communist economy than our own market economy.

In 1990, about 1 percent of American corporate profits were taken in tax havens like the Cayman Islands. By 2002, it was up to 17 percent, and it'll be up to 20-25 percent very quickly. It's a major problem. Fundamentally, we have a tax system designed for a national, industrial, wage economy, which is what we had in the early 1900s. We now live in a global, asset-based, services world. And we need to have a tax system that follows the economic order or it's going to interfere with economic growth, it's going to reduce people's incomes, and it's going to damage the US.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

The 'American dream' ... means an economy in which people who work hard can get ahead and each new generation lives better than the last one. The 'American dream' also means a democratic political system in which most people feel they can affect public decisions and elect officials who will speak for them. In recent years, the dream has been fading.

In a democracy the responsibility for the Government's economic policies, which so affect the economy, normally rests with the elected representative of the people: in our case, with the President and the Congress. If these two follow economic policies inimical to the general welfare, they are accountable to the people for their actions on election day. With Federal Reserve independence, however, a body of men exist who control one of the most powerful levers moving the economy and who are responsible to no one.

This country pays a price whenever our economy fails to deliver rising living standards to our citizens - which is exactly what has been the case for years now. We pay a price when our political system cannot come together and agree on the difficult but necessary steps to rein in entitlement spending or reform our tax system.

Embracing a low carbon economy will be as momentous as the previous industrial revolutions. As the shift from coal to oil did. And the shift from gas light to electric light. It has the potential to give us the competitive edge in the new global economy. The scale of the challenge is extraordinary. We will need to reinvent in the way we live our lives, the way our world works

By laying the groundwork for a system centered on home ownership rather than the public housing popular in Europe, the New Deal made possible the great postwar housing boom that populated the Sun Belt and boosted millions of Americans into the middle class, where, ironically, they often became Republicans.

The harsh reality is that we simply cannot tax our way out of our overspending and debt problem. We need a balanced approach that includes both a stronger economy to generate new tax revenues and bipartisan guardrails, which will help ensure that future presidents and congresses spend within our means.