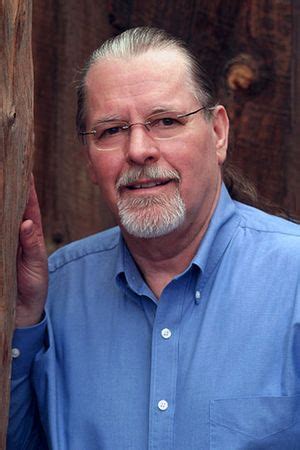

A Quote by Richard J. Foster

What is urgently needed is a bold new move from a consumer economy to a conserver economy in all of the developed countries, and particularly in the United States.

Related Quotes

The money economy thus leaves a large ecological footprint, defined as the amount of land and resources required to meet a typical consumer's needs. For example, with only about 4% of the world's population, the United States, the largest money economy, consumes in excess of one-quarter of the world's energy and materials and generates in excess of 25 percent of the world's greenhouse gas emissions.

It is truly vital for the United States to assure that it is not attacked with weapons of mass destruction; to prevent wars in other countries from spreading onto American soil; and to maintain access to global sea lanes on which our economy depends. Beyond that, there is little or nothing in the world that should draw the United States to war.

Today it's fashionable to talk about the New Economy, or the Information Economy, or the Knowledge Economy. But when I think about the imperatives of this market, I view today's economy as the Value Economy. Adding value has become more than just a sound business principle; it is both the common denominator and the competitive edge.

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

One of the reasons why this country undertook military action in Iraq was that there are quite a few problems here, and perhaps attention needed to be deflected from those problems. It sometimes seems that the U.S. economy works successfully only if it gets a stimulus from the defense industry. So perhaps in addition to showing the power and the might of the United States internationally, another reason was to help the defense industry and to help the U.S. economy recover.

As the United States continues its slow but steady recovery from the depths of the financial crisis, nobody actually wants a massive austerity package to shock the economy back into recession, and so the odds have always been high that the game of budgetary chicken will stop short of disaster. Looming past the cliff, however, is a deep chasm that poses a much greater challenge -- the retooling of the country's economy, society, and government necessary for the United States to perform effectively in the twenty-first century.

Our consumer-oriented economy wouldn't survive without economic growth. The whole mechanism depends on invention and insinuation of novelties, arousing new wants, seduction and temptation. This is the problem we face - much more than recapitalizing the banks. The question is: Is that kind of economy sustainable?