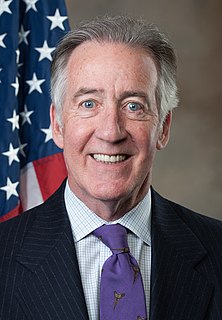

A Quote by Richard Neal

But what is striking about this, in a town that often talks about tax cuts, we could quite easily, Republicans and Democrats working together, do something that everybody in America desires, and that is a simplification of our Tax Code.

Related Quotes

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

The Democrats and Republicans need to come together. I've criticized Democrats for their unwillingness to address entitlement reform and Social Security and Medicare. Republicans, on the other hand, never saw a tax that they liked, even when it meant closing tax loopholes. They don't want to in any way support any revenue enhancements.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

Every presidential candidate for decades has released his tax returns, and I've released 33 years of my tax returns. The American people deserve to know about our taxes. And so Donald Trump is standing in the way of precedent that goes back on both sides of aisle Democrats and Republicans, and he clearly has something that he doesn't want us to see.