A Quote by Richard Neal

Let me announce this to the American people tonight one of the best things about this debate, as a Democrat from Massachusetts, I have proposed eliminating, getting rid of the alternative minimum tax.

Related Quotes

Trump himself stands to benefit dramatically from the tax cuts. One of the things they're cutting is the alternative minimum tax. Last time we have tax returns for him was in 2005, where he paid about $31 million because of the alternative minimum tax. He won't have to pay that, if this tax bill goes through. So, not only is he reordering our constitutional democracy, he is personally enriching himself - which is not new, because, of course, he's done it ever since he swore an oath to become president of the United States.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

Next, take a look at the quality of the people who surround you. Do these people back you emotionally, or not? If they don't back you, are they at least passive? If not, get rid of them. Sometimes it is hard to drop off your mates at the great bus stop of life. But remember, your energy will only rise in direct relationship to the number of things you are able to get rid of - not to the things you acquire. By getting rid of things, attitudes, encumbrances, and blocks of one kind or another, things fly.

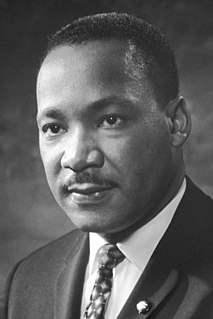

It is not enough for me to stand before you tonight and condemn riots. It would be morally irresponsible for me to do that without, at the same time, condemning the contingent, intolerable conditions that exist in our society. These conditions are the things that cause individuals to feel that they have no other alternative than to engage in violent rebellions to get attention. And I must say tonight that a riot is the language of the unheard.