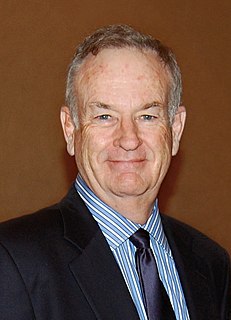

A Quote by Richard Posner

I was an advocate of the deregulation movement and I made - along with a lot of other smart people - a fundamental mistake, which is that deregulation works fine in industries which do not pervade the economy. The financial industry undergirded the entire economy and if it is made riskier by deregulation and collapses in widespread bankruptcies as what happened in 2008, the entire economy freezes because it runs on credit.

Related Quotes

I was an advocate of the deregulation movement and I made - along with a lot of other smart people - a fundamental mistake. The financial industry undergirded the entire economy and if it is made riskier by deregulation and collapses in widespread bankruptcies as what happened in 2008, the entire economy freezes because it runs on credit.

Deregulation is a popular term that's used across the political spectrum. And it's one of these terms like "choice," that corporate interests have used because they know their focus-group buzzword testing makes it sound like a popular word. Because, who can be against deregulation? Being free, having liberty, not having someone tell you what to do, being deregulated, hey, that sounds great. But deregulation is a non sequitur in the realm of media policy or media regulation. The issue is never regulation versus deregulation; our entire system is built on media policies and subsidies.

Clinton provided the final transition between decaying old-style liberalism and the new neoliberalism and neoconservatism - which are kind of incestuous first cousins. That goes for trade policy; for deregulation of major industries, from the utilities to communications companies to the banking industry to the insurance industry; all the way to continuing to wage war on Iraq. All of that is a living artifact of Clinton Time.

When I was in government, the South African economy was growing at 4.5% - 5%. But then came the global financial crisis of 2008/2009, and so the global economy shrunk. That hit South Africa very hard, because then the export markets shrunk, and that includes China, which has become one of the main trade partners with South Africa. Also, the slowdown in the Chinese economy affected South Africa. The result was that during that whole period, South Africa lost something like a million jobs because of external factors.

Legalized drugs would cause dislocations in the US economy - the prison industry for example and tens of billions spent annually on drug enforcement. But because the US economy is so large, this would be a minor blow, hardly as severe as the ultimate nightmare for the US economy, global peace, which would shutter its death industry commonly called the military/industrial complex.