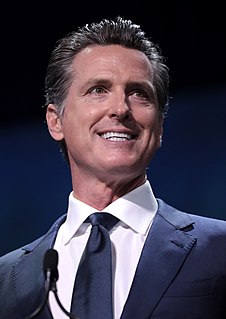

A Quote by Richard Thaler

If you're not putting enough away for emergencies or retirement, making commitments in advance, such as signing up for payroll withholding, can help.

Quote Topics

Related Quotes

I actually once sat at the back of a payroll class in America - just me and 40 women! And I'm sitting back there, learning payroll, because I want to understand it. So that when I talk to people about payroll I know what they're talking about. And I set up and managed and ran a full payroll system myself.

Commitments present themselves in delineations of black and white. You either honor your commitments or you don't. Success is the result of making and keeping commitments to your self and others, while all failed or unfinished goals, projects and relationships are the direct result of broken commitments. It's that simple, that profound, and that important.

If you've been cryocrastinating, putting off signing up for cryonics "until later", don't think that you've "gotten away with it so far". Many worlds, remember? There are branched versions of you that are dying of cancer, and not signed up for cryonics, and it's too late for them to get life insurance.

After you marry, every asset either of you acquires is jointly held. That's why you both need to be in sync on your long-term financial goals, from paying off the mortgage to putting away for retirement. Ideally, you should talk about all this before you wed. If you don't, you can end up deeply frustrated and financially spent.