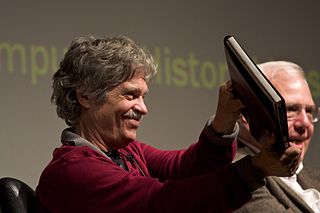

A Quote by Richard Thaler

Social Security may be the most beloved of all the government's programs, partly because it requires so little thinking. You pay taxes while you work, then you and your spouse collect until you die.

Related Quotes

Unlike most government programs, Social Security and, in part, Medicare are funded by payroll taxes dedicated specifically to them. Some of the tax revenue pays for current benefits; anything that's left over goes into trust funds for the future. The programs were designed this way for political reasons.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

No matter what anyone may say about making the rich and the corporations pay the taxes, in the end they come out of the people who toil. It is your fellow workers who are ordered to work for the Government, every time an appropriation bill is passed. The people pay the expense of government, often many times over, in the increased cost of living. I want taxes to be less, that the people may have more.

Reform immigration to make it easy for individuals to come over here, be documented, pay taxes - immigration reform is needed to state that its about work, its not about welfare... Set up a grace period where they can get a work permit... social security card so that they can pay income tax, social security, Medicare.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

The theory of government I was taught says that government provides benefits, primarily security, to the entire population. In return we pay taxes. But lately the government has been a distributor of special privileges, taking money from some and giving it to others. America is now about evenly split between those who pay income taxes and those who consume them.

Social thinking requires very exacting thresholds to be powerful. For example, we've had social thinking for 200,000 years, and hardly anything happened that could be considered progress over most of that time. This is because what is most pervasive about social thinking is 'how to get along and mutually cope.'

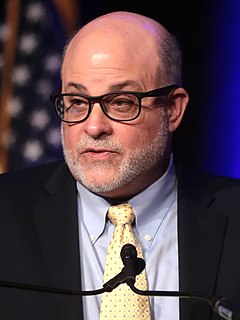

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

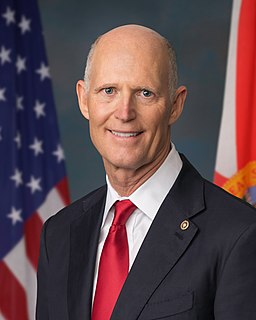

Lets all be reminded, 60 million Americans are on Social Security, 60 million. A third of those people depend on 90% of their income from Social Security. Nobody in this country is on Social Security because they made the decision when they were starting work at 14 that they wanted to trust some of their money with the government.