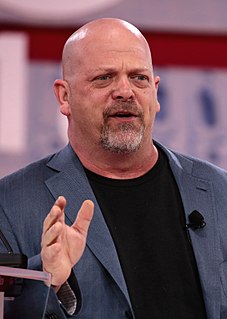

A Quote by Rick Harrison

Most people don't realize the amount of tax forms the small business guy has to go through.

Related Quotes

Opening a small business is a reasonable thing for you to do but should tax payer, should an ordinary worker have to pay more money in taxes because someone across the street from them opened up a business which might well go under? For a lot of people opening a business is a bad choice for them. Most small businesses fail. I understand people wanting to give it a try and everything but we're not necessarily doing them a favor to say, take all your life savings, borrow to the hilt, and then struggle for three years and end up with nothing. We're not necessarily doing them a favor.

Our party [Republicans] has been focused on big business too long. I came through small business. I understand how hard it is to start a small business. That's why everything I'll do is designed to help small businesses grow and add jobs. I want to keep their taxes down on small business. I want regulators to see their job as encouraging small enterprise, not crushing it.

If you continue to transfer the wealth of the population of the planet to a very small amount of people, it becomes untenable at some point, a democracy, because people eventually will realize what's going on. You can only bulls - t people through kinds of media outlets for so long, and eventually you have to physically control them.

A lot of times, I relied on connections through my agency, just for financing and things like that. Even when I'm looking for a million and a half dollars to do a small film, there can always be hold-ups, because it's a large amount of money for some people, and it's a small amount of money for other people. In any case, it's significant enough to where you have to jump through a lot of hoops to get it to happen. Sometimes, the people who are helping you can drop the ball. And, of course, the reason agents want you to do bigger projects is that they make a bigger cut.

5: Social security will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1944: The G.I. Bill will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1965: Medicare will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1994: Health care will break small business, become a huge tax burden on our citizens, and bankrupt our country!

When you can identify a specific tax that people don't like, and this is one that was designed for the Rockefellers, for the Carnegies in 1916, to fund World War I, but now it's beginning to hit small business people, real estate holders, a lot of people well down the income scale who just spent a life building assets. Suddenly they get hit with a 40%, 50% tax rate.

For years, people have been trying to talk to me about doing a show, and I wouldn't do one because I'm a serious business guy. I'm not going to do a stupid show. So, the opportunity came up with CNBC, and we started talking. It became a real business show. It's educational, people watch it, and it's great for small business.