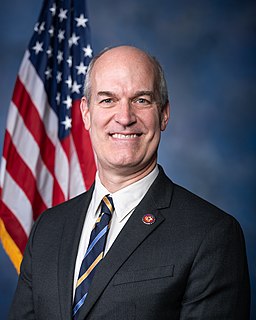

A Quote by Rick Larsen

Congress had the opportunity to extend tax relief to working families without increasing the deficit. Instead, we were handed a bill that favors the wealthy and eliminates deductions that benefit the middle class.

Related Quotes

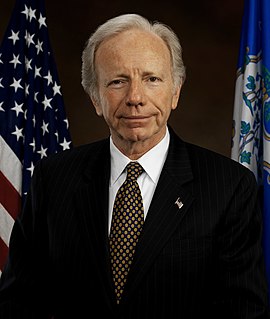

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

We no longer have a significant middle class in the US due to Barack Obama's job-killing ban on oil drilling in Zion Park. While a small middle class remains in the coastal blue states, our tax bill devastates them by curbing deductions for state and local taxes and large mortgages. In a few years, everyone except the 1% will be a tricklee.

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.