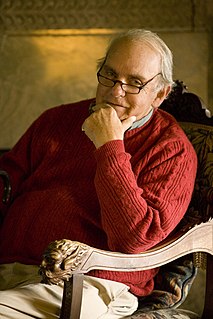

A Quote by Rick Santelli

In normal times, investors should pay more attention to the credit markets because it's the energy by which everything is driven. It's the oil in the engine.

Related Quotes

It really comes down to parsimony, economy of explanation. It is possible that your car engine is driven by psychokinetic energy, but if it looks like a petrol engine, smells like a petrol engine and performs exactly as well as a petrol engine, the sensible working hypothesis is that it is a petrol engine.

Old cars have things to say. With an old car, you have to be extra observant about everything. You have to listen and pay attention - to how the engine sounds, where the oil levels are at, if it's running hot, all of that. You've gotta be tuned in, and I like that. New cars, to me they just feel like plain sheets of metal.

From the simplest lyric to the most complex novel and densest drama, literature is asking us to pay attention. Pay attention to the frog. Pay attention to the west wind. Pay attention to the boy on the raft, the lady in the tower, the old man on the train. In sum, pay attention to the world and all that dwells therein and thereby learn at last to pay attention to yourself and all that dwells therein.

Sometimes you can't help but pay attention to what is written about you. You are trying not to because it's generally not constructive, it can be very funny, in which case it's fine to pay attention to it if you're going to laugh about it. But if it's going to get you angry then it's a pretty pointless waste of energy, so I try and be selective about what I take an interest in about myself.

I've been saying for a long time, and I think you'll agree, because I said it to you once, had we taken the oil - and we should have taken the oil - ISIS would not have been able to form either, because the oil was their primary source of income. And now they have the oil all over the place, including the oil - a lot of the oil in Libya, which was another one of her disasters.

There's the way modern music is produced, which is, 'Here's a piece of music, and I'm the producer, so pay me and make sure my credit is right and get me my splits.' But I'm trying to go backward. Now, it's more like 'What's the texture? What's the over-arching story?' There are more things to pay attention to than 'Is this the right snare?'

One day, because they realize for some reason or other that they must stop credit expansion, the banks do stop creating new credit to lend. Then the firms that have expanded cannot get credit to pay for the factors of production necessary for the completion of the investment projects which they have already committed themselves. Because they cannot pay their bills, they sell off their inventories cheap. Then comes the panic, the breakdown. And the depression starts.