A Quote by Rick Santelli

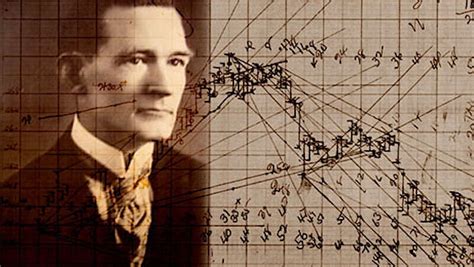

One of the greatest technicians of all time was a man named W. D. Gann (1878-1955). He had tremendous success predicting market moves much in advance. Legend has it that he occasionally sent notes to 'The Wall Street Journal', which accurately predicted tops and bottoms in grain markets months ahead of time.

Related Quotes

Occupy was not a movement, it was a tactic. You can't sit forever in a park near Wall Street. You can't do it for more than a few months. It was a tactic I had not predicted. If people asked me, I would have said "don't do it." But it was a great success, an enormous success, with a big impact on people's thinking, on people's actions.

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

To prove that Wall Street is an early omen of movements still to come in GNP, commentators quote economic studies alleging that market downturns predicted four out of the last five recessions. That is an understatement. Wall Street indexes predicted nine out of the last five recessions! And its mistakes were beauties.

OK, so here's the deal. First of all, "The Wall Street Journal" was bought for $5 billion. It's now worth $500 million, OK. They don't have to tell me what to do. "The Wall Street Journal" has been wrong so many different times about so many different things. I am all for free trade, but it's got to be fair. When Ford moves their massive plant to Mexico, we get nothing. We lose all of these jobs.

I believe the very best money is made at the market turns. Everyone says you get killed trying to pick tops and bottoms and you make all your money by playing the trend in the middle. Well for twelve years I have been missing the meat in the middle but I have made a lot of money at tops and bottoms.