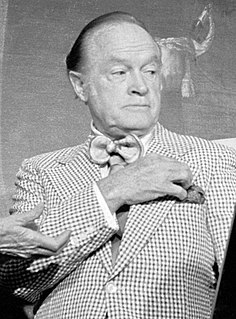

A Quote by Robert Benchley

I don't trust a bank that would lend money to such a poor risk.

Related Quotes

If two parties, instead of being a bank and an individual, were an individual and an individual, they could not inflate the circulating medium by a loan transaction, for the simple reason that the lender could not lend what he didn't have, as banks can do. Only commercial banks and trust companies can lend money that they manufacture by lending it.

In a very real way, the poor are our teachers. They show us that people’s value is not measured by their possessions or how much money they have in the bank. A poor person, a person lacking material possessions, always maintains his or her dignity. The poor can teach us much about humility and trust in God.

Who would you trust right now? Which bank would you trust? Which investment would you trust? Do you really want to put your money; do you want to suffer more of these losses that we just had? You know, these volatility that we see is just unexplainable by any rational standards. Nobody has any clue about how to explain this, and nobody wants to experience that. So, we hold more money back, we don't necessarily want to invest in the market and by default, people are saving more.

The Koreans that make their money in our community: If we have a Black bank, you'll find they don't deposit anything of what they take from us into a Black bank that would serve our community. They set up a bank in their own community. The Honorable Elijah Muhammad, my Teacher, called people like this "Bloodsuckers of the poor." All they want is to make a dollar, and run.

The problems of 2008 were never cured. The Federal Reserve's solution to the crisis was to lend the economy enough money to borrow its way out of debt. It thought that if it could subsidize banks lending homeowners enough money to buy houses from people who are defaulting, then the bank balance sheets would end up okay.