A Quote by Robert C. Merton

My principal contribution to the Black-Scholes option-pricing theory was to show that the dynamic trading strategy prescribed by Black and Scholes to offset the risk exposure of an option would provide a perfect hedge in the limit of continuous trading.

Related Quotes

Black-Scholes is a know-nothing system. If you know nothing about value - only price - then Black-Scholes is a pretty good guess at what a 90-day option might be worth. But the minute you get into longer periods of time, it's crazy to get into Black-Scholes. For example, at Costco we issued stock options with strike prices of $30 and $60, and Black-Scholes valued the $60 ones higher. This is insane.

Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.

As a society, we have this perception that women are emotional. The research, however, tells us that, on trading floors, that poor risk rises and falls with testosterone levels, and these trading floors are 85 percent, 90 percent male, and these gentlemen tend, under periods of stress, to show off for each other. That's dangerous.

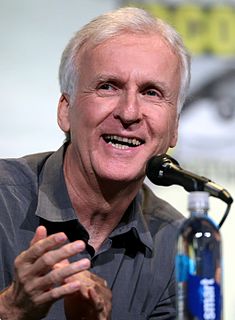

So my message is in whichever realm, be it going into space or going into the deep sea, you have to balance the yin and yang of caution and boldness, risk aversion and risk taking, fear and fearlessness. No great accomplishment takes place, whether it be a movie or a deep ocean expedition, or a space mission, without a kind of dynamic equipoise between the two. Luck is not a factor. Hope is not a strategy. Fear is not an option.