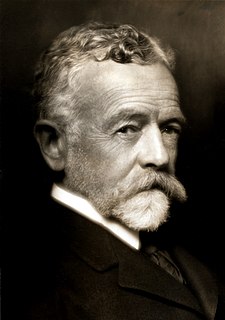

A Quote by Robert C. Solomon

If a currency is to become a growing, an increasing reserve currency, there has to be not only a demand for it there has to be a supply of it.

Related Quotes

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

The available supply of gold and silver being wholly inadequate to permit the issuance of coins of intrinsic value or paper currency convertible into coin of intrinsic value or paper currency convertible into coin in the volume required to serve the needs of the People, some other basis for the issue of currency must be developed, and some means other than that of convertibility into coin must be developed to prevent undue fluctuation in the value of paper currency or any other substitute for money intrinsic value that may come into use.

Mass production is only profitable if its rhythm can be maintained.. that is, if it can continue to sell its product in steady or increasing quantity. The result is that while, under the handicraft or small-unit system of production that was typical a century ago, demand created the supply, today supply must actively seek to create its corresponding demand.