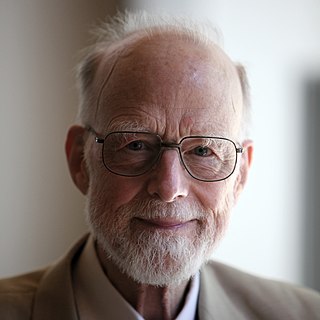

A Quote by Robert Charles Wilson

I suppose the pursuit of fashion has always carried a price, monetary or otherwise.

Related Quotes

All of the government's monetary, economic and political power, as well as its extensive propaganda machinery, will be enlisted in a constant battle to drive down the price of gold - but in the absence of any fundamental change in the nation's monetary, fiscal, and economic direction, simply regard any major retreat in the price of gold as an unexpected buying opportunity.

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

Economists may not know much. But we know one thing very well: how to produce surpluses and shortages. Do you want a surplus? Have the government legislate a minimum price that is above the price that would otherwise prevail. That is what we have done at one time or another to produce surpluses of wheat, of sugar, of butter, of many other commodities. Do you want a shortage? Have the government legislate a maximum price that is below the price that would otherwise prevail.

I love fashion because it's plugged into the zeitgeist, so it's always changing. Thirty years ago, I could never have predicted I'd be where I am today, so I know I don't know what's going to happen in the next five years or the next 20 years. I have my predictions—I'm sure technology will continue to have an impact on fashion, particularly the way people shop. I think quality will be increasingly important—we're moving away from a time of fast fashion. But really, the only constant in fashion is that you must keep moving forward, otherwise you'll be left behind.

People like to say you're either born with style or you're not, and that's complete hooey. You've gotta develop your own and find your own.If you just put on whatever they're trying to sell you, you will always be out of fashion. Otherwise, they can't keep selling you. So, you will always be out of fashion. Get used to it. That's the game. Whatever they say is fashionable, chuck it.

I do believe that oil production globally has peaked at 85 million barrels. And I've been very vocal about it. And what happens? The demand continues to rise. The only way you can possibly kill demand is with price. So the price of oil, gasoline, has to go up to kill the demand. Otherwise, keep the price down, the demand rises.