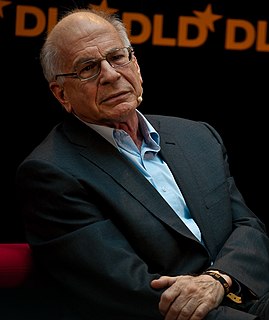

A Quote by Robert F. Engle

If you have information that a company is not as good as its stock market valuation, you don't have a way to sell that stock unless you already own it. And so that information doesn't get incorporated in the company's stock price as fast if you don't allow short selling.

Related Quotes

Allowing short selling is allowing people to sell - instead of having to buy the stock and then sell it, which doesn't do much; allow them to sell it, and then buy it. In which case they can express that information and the idea is that you would get more accurate valuation of companies by letting people express both their positive information and their negative information through either long or short selling.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

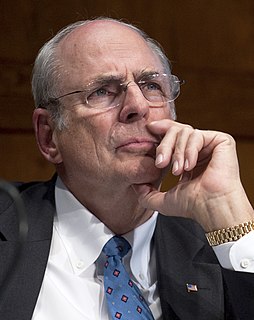

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.

Unfortunately, skill in evaluating the business prospects of a firm is not sufficient for successful stock trading, where the key question is whether the information about the firm is already incorporated in the price of the stock. Traders apparently lackthe skill to answer this crucial question, but they appear to be ignorant of their ignorance.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.