A Quote by Robert F. Engle

The advantage of knowing about risks is that we can change our behavior to avoid them. Of course, it is easily observed that to avoid all risks would be impossible; it might entail no flying, no driving, no walking, eating and drinking only healthy foods, and never being touched by sunshine. Even a bath could be dangerous.

Related Quotes

But risks must be taken because the greatest hazard in life is to risk nothing. The person who risks nothing, does nothing, has nothing, is nothing. He may avoid suffering and sorrow, but he cannot learn, feel, change, grow or live. Chained by his servitude he is a slave who has forfeited all freedom. Only a person who risks is free. The pessimist complains about the wind; the optimist expects it to change; and the realist adjusts the sails

"Just try and remember," I said slowly," that if God had intended men to fly He'd have given us wings. So all flying is flying in the face of nature. It's unnatural, wicked and stuffed with risks all the time. The secret to flying is learning to minimize the risks." "Or perhaps - the secret of life is to choose your risks?"

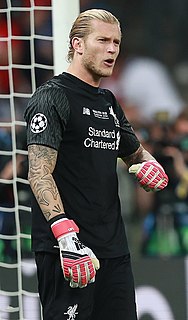

Every goalkeeper has a different way of playing. Some will take risks to help the team - coming for high balls, being prepared to be attacked in the box knowing there is not much protection from the referees - but that might mean they make more mistakes. Some try to be safer to avoid those situations, but it does not help the team.

In the next century, we will be inventing radical new technologies - machine intelligence, perhaps nanotech, great advances in synthetic biology and other things we haven't even thought of yet. And those new powers will unlock wonderful opportunities, but they might also bring with them certain risks. And we have no track record of surviving those risks. So if there are big existential risks, I think they are going to come from our own activities and mostly from our own inventiveness and creativity.

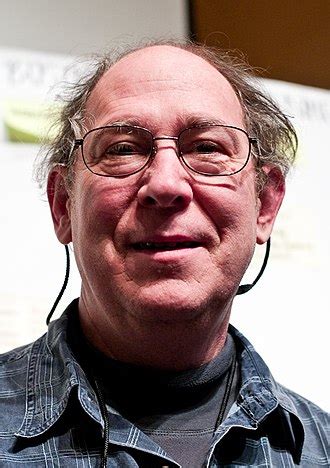

The trouble is that the risks that are being hedged very well by new financial securities are financial risks. And it appears to me that the real things you want to hedge are real risks, for example, risks in innovation. The fact is that you'd like companies to be able to take bigger chances. Presumably one obstacle to successful R&D, particularly when the costs are large, are the risks involved.