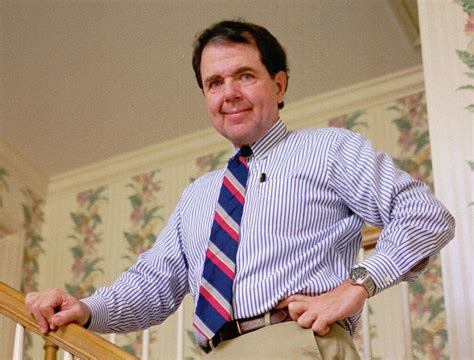

A Quote by Robert G. Allen

How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.

Related Quotes

I think wealthy conservatives are busy investing in profit and job creation and enterprise, and wealthy liberals, many of them either from the media industry themselves or from - they recognize the value of communications and are more ready to put money into a less profitable enterprise, namely the media.

But that's not how most of the people mentioned in this book became wealthy. Most of them became wealthy by being well connected and crooked. And they are creating a society in which they can commit hugely damaging economic crimes with impunity, and in which only children of the wealthy have the opportunity to become successful.