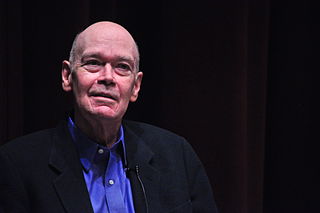

A Quote by Robert H. Frank

Rising inequality hasn't really accomplished anything of value for its ostensible beneficiaries, the top one percent. They've all built bigger mansions and staged more lavish parties. But in so doing, they've simply raised the bar that defines what's considered adequate in these categories.

Related Quotes

Many decry rising inequality because it makes those who've fallen behind feel impoverished. But it's done much more than cause hurt feelings. It has also raised the real cost to middle-income families of achieving many basic goals. The process begins with the completely unremarkable fact that top earners have been spending at a substantially higher rate than before. They've been building bigger mansions, staging more elaborate weddings and coming-of-age parties for their kids, buying more and better of everything.

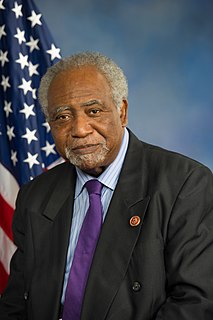

If I were to look back on my work, I think I accomplished probably about 70 to 75 percent of what I could have. Maybe 60 percent. Somewhere in that area; two-thirds of what I could have accomplished. If I had been a really dedicated person, and really worked hard, I think I could have accomplished more.

I worry about growing income inequality. But I worry even more that the discussion is too narrowly focused. I worry that our outrage at the top 1 percent is distracting us from the problem that we should really care about: how to create opportunities and ensure a reasonable standard of living for the bottom 20 percent.

Most people believe that inequality is rising - and indeed it has been rising for a while in a number of rich countries. And there is lots of talk and realization of this. It's harder to understand that at the same time, you can actually have global inequality going down. Technically speaking, national inequality can increase in every single country and yet global inequality can go down. And why it is going down is because very large, populous, and relatively poor countries like India and China are growing quite fast.

The bottom quarter of the human population has only three-quarters of one percent of global household income, about one thirty-second of the average income in the world, whereas the people in the top five percent have nine times the average income. So the ratio between the averages in the top five percent and the bottom quarter is somewhere around 300 to one - a huge inequality that also gives you a sense of how easily poverty could be avoided.

When romances do really teach anything, or produce any effective operation, it is usually through a far more subtle process than the ostensible one. The author has considered it hardly worth his while, therefore, relentlessly to impale the story with its moral as with an iron rod-or, rather, as by sticking a pin through a butterfly-thus at once depriving it of life, and causing it to stiffen in an ungainly and unnatural attitude.

The greatest danger to an adequate old-age security plan is rising prices. A rise of 2% a year in prices would cut the purchasing power of pensions about 45% in 30 years. The greatest danger of rising prices is from wages rising faster than output per man-hour.... Whether the nation succeeds in providing adequate security for retired workers depends in large measure upon the wage policies of trade unions.