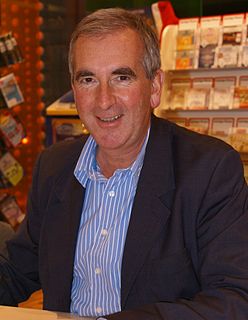

A Quote by Robert Harris

We live in an age of great jitteriness in the financial markets. And there's no doubt at all, I think, that the volume of computer-traded stocks has helped contribute to that.

Related Quotes

The industry financial advisers, on average about 85% male, tends to be a more mature financial adviser - so I think in their 50s, really. For so many companies, in their 60s. In fact, there is one company that was telling me they had more financial advisers over the age of 80 than under the age of 30.