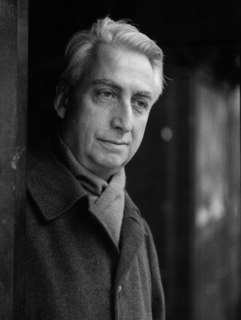

A Quote by Robert Hughes

Now that rates are moving up, we're seeing more aggressive offerings from banks.

Related Quotes

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.

Zbigniew Brzezinski, who was really one of the - whose name is impossible to pronounce - who was really one of the architects of this very aggressive American interventionist foreign policy, you know, really stand up to Russia, challenge them, not only Russia but China. He's changed his tune now and is basically advocating for a much more diplomatic and collaborative approach to the other power centers of the world that are just kind of moving on without us right now.

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

Ironically, though our society of affluence brings safety and stability, it doesn't bring psychological health. As wealth goes up, suicide and depression rates tend to go up. I read one study that compared women in North America with women in Nigeria, and the group with the highest rates of depression was urban North American women, which is the wealthiest. Now, there are obviously huge stresses that come with poverty, but the poorer the society, the more collaborative people have to be.

It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.