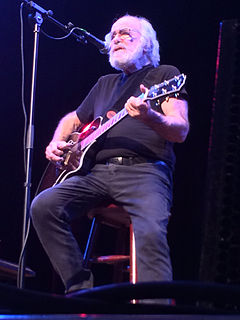

A Quote by Robert Hunter

I don't believe there's any evidence that credit scoring is a risk factor. What is it about someone having a worse credit score that makes them a worse driver? (Insurers) can't answer that.

Related Quotes

There are worse things than having behaved foolishly in public. There are worse things than these miniature betrayals, committed or endured or suspected; there are worse things than not being able to sleep for thinking about them. It is 5 a.m. All the worse things come stalking in and stand icily about the bed looking worse and worse and worse.

The interesting thing about the China story, getting back to the macro and micro, and as dire as I think the macro story is - due to bad credit and credit extension that makes Greece and Spain and the U.S. look like child's play - when you get to the micro of individual companies, they look even worse.

In about one-third of credit card consolidations, within a short period of time, the cards come back out of the wallet, and in no time at all, they're charged back up. Then you're in an even worse position, because you have the credit card debt and the consolidation loan to worry about. You're in a hole that's twice as deep - and twice as steep.

If all other risk factors are normal, and you exercise moderately, your risk of having high CRP is one in 2000, .. A person who is a little overweight, with blood fats and cholesterol a little elevated, maybe with a little bit of high blood pressure -- we didn't used to think that having several of these little risk factors were a big deal. But it is. These little risk factors add up in a way that is worse for you than one big risk factor.

The world is a puzzling place today. All these banks sending us credit cards, with our names on them. Well, we didn't order any credit cards! We don't spend what we don't have. So we just cut them in half and throw them out, just as soon as we open them in the mail. Imagine a bank sending credit cards to two ladies over a hundred years old! What are those folks thinking?

We can think about how we reduce the pain in paying. So, for example, credit cards are wonderful mechanisms to reduce the pain of paying. If you go to a restaurant and you are paying cash, you would feel much worse than if you were paying with credit card. Why? You know the price, there's no surprise, but if you're paying cash, you feel a bit more guilt.

I think the credit default swaps can take the place of the rating agencies who really have missed the ball in this procedure and are quite conflicted by the way the ratings are paid for. So, I would like to see credit default swaps become an evermore important way of understanding credit risk in the economy.