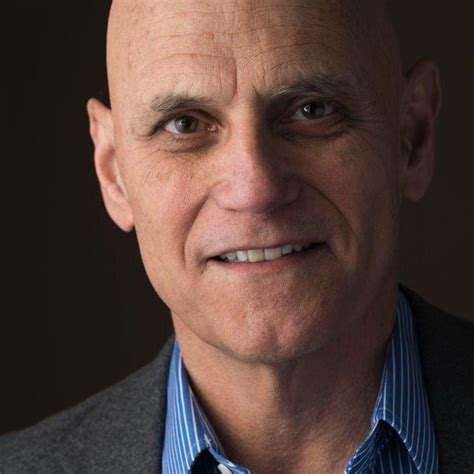

A Quote by Robert J. Shiller

The good news is that, at least in economics, I've seen movement away from its overemphasis on mathematical models of purely rational behavior to a more eclectic and commonsense approach: research that is, among other things, more respectful of insights from psychology.

Related Quotes

The possibility that stock value in aggregate can become irrationally high is contrary to the hard-form "efficient market" theory that many of you once learned as gospel from your mistaken professors of yore. Your mistaken professors were too much influenced by "rational man" models of human behavior from economics and too little by "foolish man" models from psychology and real-world experience.

When you look at any experimental work not directly related to economics, but trying to test rational behavior in other ways, experiments have conspicuously failed to show rational behavior. Macro evidence certainly suggests deviations from rationality, but I don't want to say the rationality hypothesis is completely wrong. If you have any introspective idea or experimental idea about people's behavior, it seems to be incompatible with the really full scale rational expectations.

If the system exhibits a structure which can be represented by a mathematical equivalent, called a mathematical model, and if the objective can be also so quantified, then some computational method may be evolved for choosing the best schedule of actions among alternatives. Such use of mathematical models is termed mathematical programming.

Investing is the intersection of economics and psychology. The analysis is actually the easy part. The economics, the valuation of the business isn't that hard. The psychology - how much do you buy, do you buy it at this price, do you wait for a lower price, what do you do when it looks like the world might end - those things are harder. Knowing whether you stand there, buy more, or whether something has legitimately gone wrong and you need to sell, those are harder things. That you learn with experience, by having the right psychological makeup.

Positivity psychology is part and parcel of psychology. Being human includes both ups and downs, opportunities and challenges. Positive psychology devotes somewhat more attention to the ups and the opportunities, whereas traditional psychology - at least historically - has paid more attention to the downs.

Christianity is not about good people getting better. If anything, it is good news for bad people coping with their failure to be good. The heart of the Christian faith is Good News, not good advice, good technique, or good behavior. Too many people have walked away from the church, not because they’re walking away from Jesus, but because the church has walked away from Jesus.

ACT psychology is a psychology of the normal. A lot of the psychologies that are out there are built on the psychology of the abnormal. We have all these syndromal boxes that we can put people in and so forth. The actual evidence on syndromes is not very good. There's no specific biological marker for any of the things that you see talked about in the media. Even things like schizophrenia - there's no specific and sensitive biological markers for these things. There may be some abnormal processes involved, but vastly more of human suffering comes from normal processes that run away from us.

How should the best parts of psychology and economics interrelate in an enlightened economist's mind?... I think that these behavioral economics...or economists are probably the ones that are bending them in the correct direction. I don't think it's going to be that hard to bend economics a little to accommodate what's right in psychology.

Mathematics is much more than a language for dealing with the physical world. It is a source of models and abstractions which will enable us to obtain amazing new insights into the way in which nature operates. Indeed, the beauty and elegance of the physical laws themselves are only apparent when expressed in the appropriate mathematical framework.