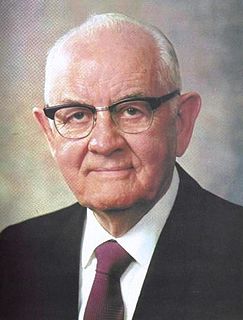

A Quote by Robert J. Shiller

This is the paradox of thrift: belt-tightening causes people to lose their jobs, because other people are not buying what they produce, so their debt burden rises rather than falls.

Related Quotes

We're in a classic demand-shortfall recession. There aren't enough jobs because total spending is too low. Consumers won't lead the way because they're busy paying down debt and are fearful they'll lose their jobs, if they haven't already. Businesses, which are currently sitting on mountains of cash, won't spend either, because they already have sufficient capacity to produce more than people are willing to buy.

People tend to think that paying a debt is like going out and buying a car, buying more food or buying more clothes. But it really isn't. When you pay a debt to the bank, the banks use this money to lend out to somebody else or to yourself. The interest charges to carry this debt go up and up as debt grows.

In a system of capitalism, as people's wealth rises, the financial incentive to serve them rises. As their wealth falls, the financial incentive to serve them falls, until it becomes zero. We have to find a way to make the aspects of capitalism that serve wealthier people serve poorer people as well.

Many respected economists and statesmen believe our national debt is neither unwieldy nor a dangerous burden on the country. The trouble is that a vast majority of the American people think otherwise.... It violates basic American ideas of thrift and money management. These strong public feelings cannot be ignored forever.

I've said that we're going to produce real results for the American people because so many Americans feel left out and left behind, they think the economy has failed them, they think our government has failed, they can't stand the gridlock and dysfunction in our politics, and I'm determined to produce more good jobs with rising incomes, and deal with all of the concerns that families have about education, college affordability, student debt.

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.