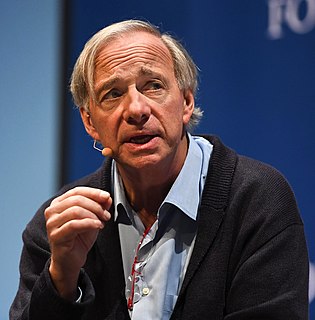

A Quote by Robert J. Shiller

One should have a wide variety of assets in one's portfolio. And oil, by the way, is a particularly important asset to have in one's portfolio because we need it, and the economy thrives on it.

Related Quotes

We've got a portfolio of companies that range all the way from hotels to television stations and cable TV companies, oil and gas, consumer products, and industrial products. If there's anything that I want to know more about, I have the opportunity. It's right in our portfolio. I can spend time at the factory or with the manangement and learn as much as I want. You can't get bored doing that.

There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically. The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

In going directly to Investment Heaven, you build your portfolio as you would build a wonderful company through a merger and acquisition program. You specify the way you want your portfolio to look, and then you assemble the profile piece by piece by bringing together companies that make their own individual contributions to the desired character.