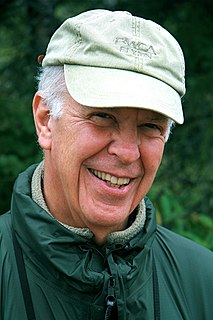

A Quote by Robert J. Shiller

Speculative markets have always been vulnerable to illusion. But seeing the folly in markets provides no clear advantage in forecasting outcomes, because changes in the force of the illusion are difficult to predict.

Related Quotes

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

The part of you that is unhampered by illusion-the illusion of time, the illusion of powerlessness, the illusion of impossibility-i s waiting for you to slow down and open up so that it can speak to your consciousness. In some unguarded moment, you will hear its wildly improbable words and know that they are guiding you home.

The being we call god is merely a pawn working for a powerful and rational force in some far-off galaxy. This force is trying to weed out people who are irrational by seeing who would be stupid enough to believe in his god illusion so easily. Those that believe in this illusion, he will send to eternal damnation and he will deliver the rational beings, those who stoically refused to believe in a god, to heaven.

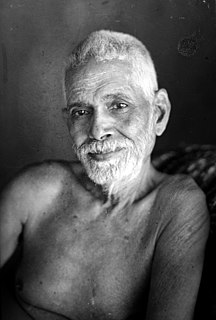

What is illusion? M.: To whom is the illusion? Find it out. Then illusion will vanish. Generally people want to know about illusion and do not examine to whom it is. It is foolish. Illusion is outside and unknown. But the seeker is considered to be known and is inside. Find out what is immediate, intimate, instead of trying to find out what is distant and unknown.

Markets are a social construction, they're made from institutions. We in a democratic society create markets, we constitute markets, we bring them into existence, and we shouldn't turn markets over to a narrow group of people who regulate them and run them in their interests, rather they should be run democratically for the common good.