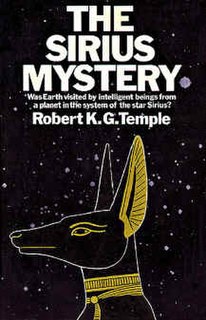

A Quote by Robert K. G. Temple

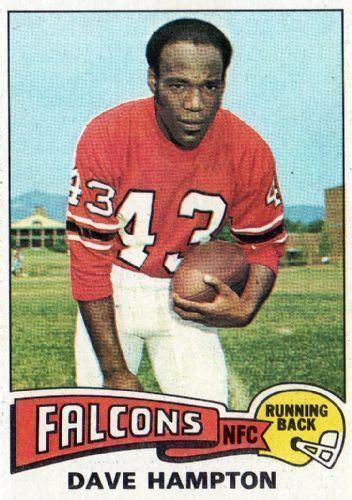

My basic rule is if the relative risk isn't at least 3 or 4, forget it.

Related Quotes

10 Rules for Being Human: Rule #1 - You will receive a body. Rule #2 - You will be presented with lessons. Rule #3 - There are no mistakes, only lessons. Rule #4 - The lesson is repeated until learned. Rule #5 - Learning does not end. Rule #6 - "There" is no better than "here". Rule #7 - Others are only mirrors of you. Rule #8 - What you make of your life is up to you. Rule #9 - Your answers lie inside of you. Rule #10 - You will forget all this at birth.

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

To laugh is to risk appearing a fool. To weep is to risk appearing sentimental. To reach out to another is to risk involvement. To expose feelings is to risk exposing your true self. To place your ideas and dreams before a crowd is to risk their loss. To love is to risk not being loved in return. To hope is to risk pain. To try is to risk failure. But risks must be taken, because the greatest hazard in life is to risk nothing.